(Media release from the Office of Governor Brian Kemp):

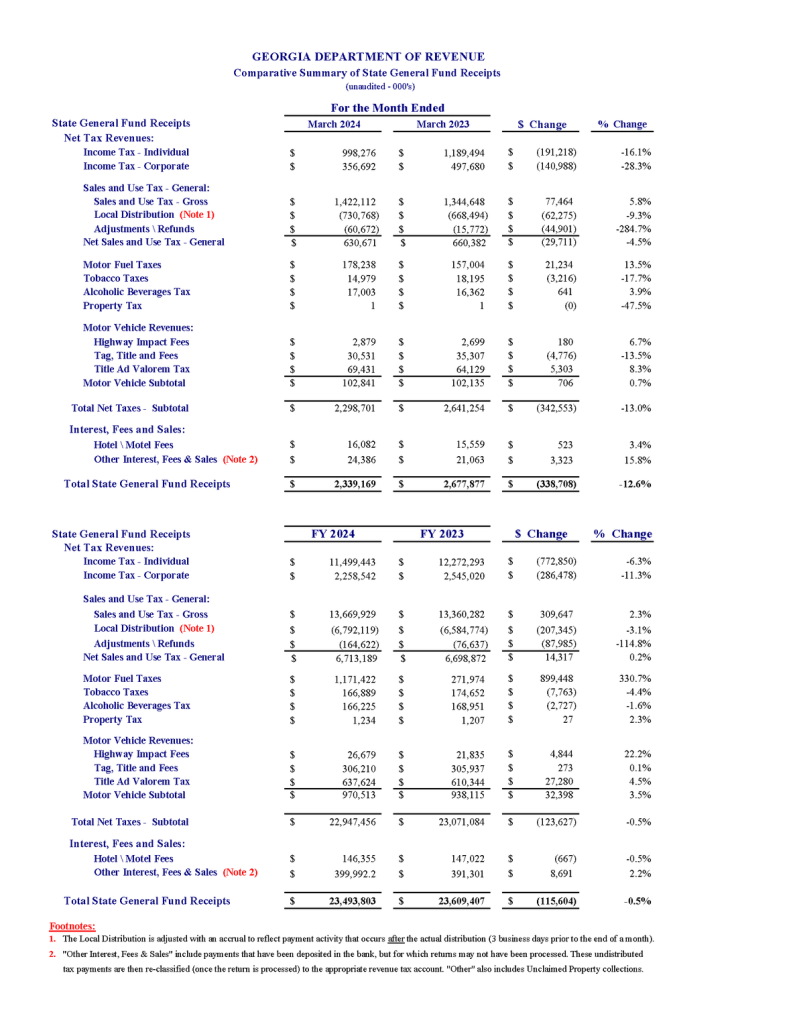

The State of Georgia’s net tax collections in March totaled $2.34 billion, for a decrease of $338.7 million or 12.6 percent compared to FY 2023, when net tax collections approached a total of $2.68 billion for the month.

Year-to-date, net tax revenue totaled $23.49 billion, for a decrease of $115.6 million or 0.5 percent from the same nine-month period in FY 2023, a period during which the state’s motor fuel excise tax was suspended. Net of motor fuel tax changes, revenues for the nine months ended March 31 were down 4.3 percent from this time a year ago.

The changes within the following tax categories help to further explain March’s overall net tax revenue decrease:

Individual Income Tax: Individual Income Tax collections totaled $998.3 million, for a decrease of $191.2 million or 16.1 percent compared to last year, when Individual Tax collections totaled nearly $1.19 billion. This is in part attributable to the planned reduction in income tax rates effective January 1, 2024.

The following notable components within Individual Income Tax combine for the net decrease:

• Individual Income Tax refunds issued (net of voided checks) were down $79.3 million or 11.1 percent

• Individual Withholding payments were down by $228.2 million or 13.7 percent from the previous year

• Individual Income Tax Return payments declined by $28.4 million or 23 percent from March 2023

• All other Individual Tax categories, including Estimated payments, were down a combined $13.9 million

Sales and Use Tax: Gross Sales and Use Tax collections totaled $1.42 billion for the month, which was an increase of $77.5 million or 5.8 percent compared to March 2023. Net Sales and Use Tax decreased by $29.7 million or 4.5 percent compared to last year, when net sales tax totaled $660.4 million. The adjusted Sales Tax distribution to local governments totaled $730.8 million, for an increase of $62.3 million or 9.3 percent, while Sales Tax refunds increased by $44.9 million or 284.7 percent compared to FY 2023.

Corporate Income Tax: Corporate Income Tax collections for March totaled $356.7 million, for a decrease of roughly $141 million or 28.3 percent compared to FY 2023.

The following notable components within Corporate Income Tax make up the net decrease:

• Corporate Income Tax refunds issued (net of voided checks) were up $41.6 million or 88 percent over FY 2023

• Corporate Income Tax Estimated payments decreased by $62.9 million or 91.8 percent from the previous year

• All other Corporate Tax types, including Corporate Return payments, were down a combined $36.5 million

Motor Fuel Taxes: Motor Fuel Tax collections increased by $21.2 million or 13.5 percent over last year.

Motor Vehicle – Tag & Title Fees: Motor Vehicle Tag & Title Fees decreased by $4.8 million or 13.5 percent for the month, while Title Ad Valorem Tax (TAVT) collections increased by $5.3 million or 8.3 percent over last year.